Every genealogist would agree that census records are valuable sources for genealogical research, often providing solid evidence for family relationships. They can also help establish a person’s residence in a time and place and can be used to trace a person through time and provide information about neighbors. Clues leading to additional records such as military, immigration and naturalization, and land records can also be found in census records.

Although pre-1850 censuses only name the head of household, they are still valuable records that place an ancestor in a specific place and time. They also provide indirect evidence about the makeup of a household that can be used with other evidence to learn more about our ancestors. When I am looking for possible paternal candidates for a person born before 1850, I often use census records to discover men with the same surname living in the same locality as the research subject that have a child of the correct age and gender to be the research subject in their household.

I have recently been working on a project to discover the father of thirteen children with the surname Norman written on a page torn from a family bible.[1] They were likely born somewhere along the border of New York and New Jersey. Born between 1763 and 1789, at least some of them would have been living in their father’s home at the time the 1790 federal census was enumerated.

No Norman man was enumerated in this area of New York in 1790 and unfortunately, the United States censuses prior to 1830 for the state of New Jersey have not survived. How can researchers overcome this gaping hole in the records? Enter New Jersey tax ratables. In addition to providing evidence of a person’s residence, other clues can be gained from these records. Young men began being taxed when they came of age or when they became the head of a household. If a man was designated as “Jr.” it could be the first time the son of the same name was listed in the records. Women were only listed if they were the head of a household.

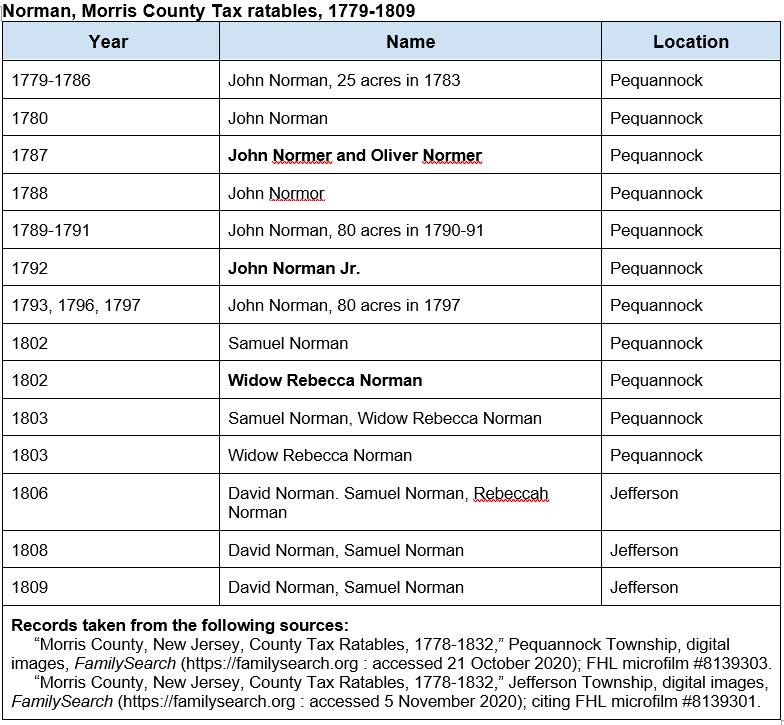

New Jersey Tax Ratables are available beginning in 1778. Later records for the children listed on the bible record have been found in Sussex and Morris Counties. Analyzing tax lists from Pequannock Township in Morris County revealed the following information:

It is important to note that Oliver, John, Samuel, and David are the names of four of the male children listed on the bible page. As can be seen in the table above, a John Norman lived in Pequannock Township by at least 1779. The eldest son, Oliver, was born in 1763, making him 16 in 1779. John Norman would not be any of the sons listed on the bible page, as they were not yet old enough to be taxed. The John Norman of Pequannock from 1779-1791 is a possible father of the Norman children appearing on the family bible page.

The John and Oliver Normer that both appear on the tax lists in 1787 could be father and son. Oliver, born in 1763, would have been 24 at the time. Normer might have been a mis-transcription of the record, as the documents I examined were copies of the original records.

In 1792, a John Norman Jr. appeared in the tax lists. The John from the bible page would have been 27 by this time. Perhaps this is when he became the head of his own household. The designation of Jr. would have distinguished him from his father, John Sr.

The widow Rebecca Norman who appeared on the tax lists beginning in 1802 is also of interest. Could she be the widow of John Norman Sr.? One clue is that she was taxed on 34 acres of land, the same amount as Samuel Norman. When a man died, his widow was entitled to dower rights, which equal ⅓ of the estate of the deceased man.[2] Rebecca’s being taxed on 34 acres of land, along with Samuel’s tax on 34 acres point to the possibility that Rebecca’s husband had died and his property had been split into equal portions. Who received the other third? No clues were discovered in the research. Although these clues can be used to make hypotheses, a full picture of land ownership among the Norman men has not yet emerged.

According to their undocumented profiles at FamilySearch, three of the Norman brothers married women named Rebecca.[3] Could one of their wives be the widow Rebecca Norman? Oliver Norman is said to have been married to Rebecca Chamberlain in 1789, John Norman Jr. is said to have married Rebecca Decker (year unknown), and Peter Norman is said to have married Rebecca Chamberlain in 1804. None of these brothers seem likely candidates to be the deceased husband of Rebecca Norman, who was listed as a widow on tax records beginning in 1802.

Oliver supposedly lived until 1826, when he died in Ohio, where he is likely buried. No documentary evidence has yet been discovered to prove Oliver’s migration to Ohio or his death. However, Oliver did appear in land records, purchasing a tract of land in Hardiston Township in 1808.[4] This land record proves that Oliver was clearly not deceased by 1808, so the widow Rebecca Norman could not be his wife.

John Norman Jr.’s undocumented profile at FamilySearch gives an exact death date of 13 March 1811. If this date is accurate, the widow Rebecca Norman would not be his wife. No John Norman appeared in tax records in Morris County after 1802, so there is a chance that John Norman Jr.’s death date at FamilySearch is inaccurate and that Rebecca was his widow.

Peter Norman lived until 1863. He is also said to have married Rebecca Chamberlain about 1804. Because Rebecca Norman again appeared in the tax records in 1806, it is unlikely that Rebecca Chamberlain, first wife of Oliver Norman and then married to Peter Norman, is the widow Rebecca Norman of the tax lists.

Based on undocumented dates, it seems more likely that Rebecca Norman is the widow of John Norman Sr. who likely died between 1797 and 1802. Additional research will one day solidify these dates and clarify the picture.

Another item of note from the tax lists is that the members of the Norman family all disappeared from the Pequannock tax lists beginning in 1804. This is the date when Jefferson Township was formed from Pequannock Township.[5] Rebecca Norman was taxed on 34 acres of land in Pequannock in 1802 and then 34 acres in Jefferson Township in 1806. Because of her identical tax in two different townships, it is probable that she and other family members lived in the same place over the years, but that their property was part of the new Jefferson Township when its formation took place.

Rebecca Norman disappeared from the tax lists from 1807-1809. Perhaps she died or got remarried. Samuel and David Norman continued to be listed on the tax ratables in Morris County until 1809. Tax lists beyond 1809 were not examined during this research session, and tax tables from Sussex County have not yet been consulted. A similar study of Normans in Sussex County could reveal additional information about the family.

As you can see, New Jersey tax lists proved very helpful in finding a potential father for the Norman children, and helped provide a picture of the family’s identity and actions despite the loss of early New Jersey censuses. In fact, tax lists are a valuable resource even when census records are extant because they were typically created more often, even annually.

How have you used tax records in your research?

Sources:

[1] Find a Grave, database with images, (https://www.findagrave.com : accessed 13 July 2020), memorial #184481392, CPT John “Peter” Norman, Sr. (1735-1795); citing Sparta Cemetery, Sparta, Sussex County, New Jersey; maintained by Ruth Norman Martinez, contributor 49337640. An image of the Bible record appears on this page. Most researchers have assumed that Captain John “Peter” Norman is the father of the children, but no evidence connecting the children with this father has yet been discovered. [2] Marylynn Salmon, “The Legal Status of Women, 1776-1830,” The Gilder Lehrman Institute of American History (https://ap.gilderlehrman.org/essay/legal-status-women : accessed 14 January 2021). [3] FamilySearch (https://familysearch.org : accessed 21 July 2020), database, profile for Oliver Norman, K2N1-HFZ. FamilySearch (https://familysearch.org : accessed 21 July 2020), database, profile for John Norman, KZF1-KSR. FamilySearch (https://familysearch.org : accessed 22 July 2020), database, profile for Peter Norman, K6M6-3F2. [4] New Jersey State Archives “Early Land Records, 1650s-1990s,” State of New Jersey Department of State (https://wwwnet-dos.state.nj.us/DOS_ArchivesDBPortal/EarlyLandRecords.aspx : accessed 30 November 2020), EJ Loose Records : S15-397, Hardiston Township, Sussex, New Jersey, Oliver Norman, grantee; digital copy privately held by Alice Childs. [5] “Jefferson Township, New Jersey,” Wikipedia (https://en.wikipedia.org/wiki/Jefferson_Township,_New_Jersey : accessed 14 January 2021). Jefferson Township was formed on February 11, 1804 from portions of Pequannock Township and Roxbury Township.